Exactly How Animals Risk Security (LRP) Insurance Coverage Can Secure Your Livestock Investment

In the world of animals financial investments, mitigating dangers is critical to making certain economic stability and growth. Livestock Threat Protection (LRP) insurance coverage stands as a reputable shield against the unpredictable nature of the marketplace, providing a tactical technique to safeguarding your assets. By diving right into the intricacies of LRP insurance and its multifaceted advantages, animals manufacturers can fortify their investments with a layer of safety that goes beyond market fluctuations. As we check out the world of LRP insurance coverage, its function in safeguarding animals financial investments ends up being progressively obvious, promising a course towards sustainable economic resilience in a volatile industry.

Comprehending Livestock Risk Protection (LRP) Insurance Coverage

Comprehending Animals Danger Security (LRP) Insurance is necessary for animals producers wanting to minimize monetary risks connected with price fluctuations. LRP is a government subsidized insurance coverage product designed to secure producers versus a decline in market rates. By providing protection for market price decreases, LRP aids manufacturers lock in a flooring rate for their animals, guaranteeing a minimum degree of income despite market variations.

One trick element of LRP is its adaptability, permitting manufacturers to personalize coverage degrees and policy sizes to suit their certain requirements. Producers can choose the number of head, weight array, insurance coverage rate, and protection period that line up with their manufacturing goals and risk tolerance. Understanding these adjustable options is essential for manufacturers to efficiently manage their cost risk exposure.

Additionally, LRP is readily available for numerous livestock types, including livestock, swine, and lamb, making it a versatile threat monitoring device for animals producers across various fields. Bagley Risk Management. By acquainting themselves with the complexities of LRP, manufacturers can make enlightened decisions to secure their financial investments and guarantee financial security in the face of market uncertainties

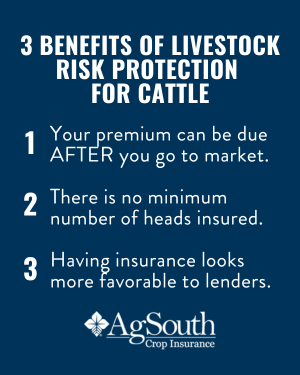

Benefits of LRP Insurance for Animals Producers

Animals manufacturers leveraging Livestock Danger Protection (LRP) Insurance policy obtain a strategic advantage in shielding their investments from rate volatility and safeguarding a stable economic ground in the middle of market unpredictabilities. By establishing a flooring on the rate of their livestock, producers can alleviate the risk of considerable financial losses in the event of market recessions.

Furthermore, LRP Insurance policy gives producers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for livestock producers are considerable, supplying a valuable tool for taking care of risk and guaranteeing monetary safety in an unpredictable market atmosphere.

How LRP Insurance Policy Mitigates Market Risks

Mitigating market threats, Animals Risk Defense (LRP) Insurance provides animals manufacturers with a reputable guard versus cost volatility and monetary uncertainties. By offering security versus unexpected price declines, LRP Insurance policy assists manufacturers secure their investments and keep monetary stability in the face of market variations. This kind of insurance coverage allows livestock producers to secure in a rate for their pets at the start of the policy duration, making sure a minimal cost level regardless of market adjustments.

Actions to Safeguard Your Animals Financial Investment With LRP

In the world of agricultural threat administration, implementing Livestock Risk Protection (LRP) Insurance policy involves a calculated process to guard financial investments versus market fluctuations and unpredictabilities. To safeguard your animals financial investment effectively with LRP, the initial step is to analyze the specific risks your procedure deals with, such as price volatility or unexpected climate occasions. Next off, it is crucial to research and pick a credible insurance policy carrier that supplies LRP plans tailored to your animals and service requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Guaranteeing withstanding financial stability through the utilization of Animals Danger Defense (LRP) Insurance coverage is a sensible long-lasting strategy for farming producers. By including LRP Insurance coverage into their risk management strategies, farmers can protect their livestock financial investments against unpredicted market variations and negative events that can endanger their monetary wellness with time.

One trick advantage of LRP Insurance for lasting economic safety is the comfort it provides. With a reputable insurance coverage policy in position, farmers can reduce the financial risks connected with unstable market problems and unforeseen losses because of variables such as disease outbreaks or natural calamities - Bagley Risk Management. This security enables producers to concentrate on the everyday procedures of their livestock service without continuous stress over prospective economic problems

In Addition, LRP Insurance coverage supplies a structured method to handling threat over the long-term. By establishing details protection levels and choosing appropriate endorsement durations, farmers can customize their insurance coverage intends to line up with their financial objectives and risk resistance, making sure a lasting and protected future for their livestock operations. Finally, investing in LRP Insurance policy is an aggressive strategy for farming manufacturers to attain lasting monetary you can try here safety and protect their incomes.

Verdict

Finally, Livestock Risk Defense (LRP) Insurance is a useful device for animals producers to minimize market threats and safeguard their financial investments. By recognizing the benefits of LRP insurance coverage and taking actions to execute it, producers can accomplish lasting financial safety and security for their operations. LRP insurance gives a security web versus rate variations and makes sure a degree of security in an uncertain market atmosphere. It is a smart option for safeguarding livestock investments.